Access Working Capital Solutions

In need of financing, cash flow optimization, or expert guidance? We provide the tools and support to ensure your business thrives and remains financially agile.

Join thousands of Grow customers

Let’s become unstoppable together!

As aVendor

Grow Finance empowers businesses to unlock cash flow potential and fuel business growth. Cash flow challenges due to delayed payments will be a thing of the past.

- Convert your invoices into opportunities to get paid faster and gain access to more business prospects.

- Reduce your cost of borrowing and access funding with flexible interest rates.

- Plan more effectively for your business needs with predictable funding.

- Receive funding in just 24 to 48 hours from the moment you make a request.

As an Issuer

(Corporate Buyers)

Grow Finance provides the necessary working capital to bridge cash flow gaps enabling organizations to meet their financial obligations, pay vendors promptly, and maintain project momentum.

- Ensure your vendors receive prompt payment for their services, enabling them to fulfill orders on time.

- Reduce financial stress and eliminate cash flow gaps to free up working capital.

- Strengthen your supply chain process by ensuring your vendors have timely access to funds, reducing disruptions and enhancing overall stability.

- Free up cash by reducing the amount of outstanding payables to vendors.

As a Funder

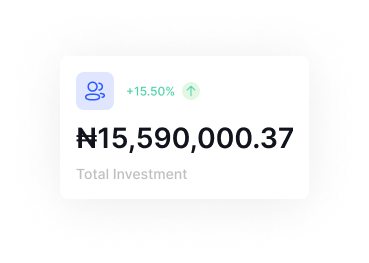

Access a world of investment opportunities while contributing to the success of businesses in need. As a funder on Grow Finance, enjoy diverse investment opportunities across various industries and projects, all designed to provide attractive returns.

- Gain access to a wide range of investment opportunities, allowing for diversified portfolios.

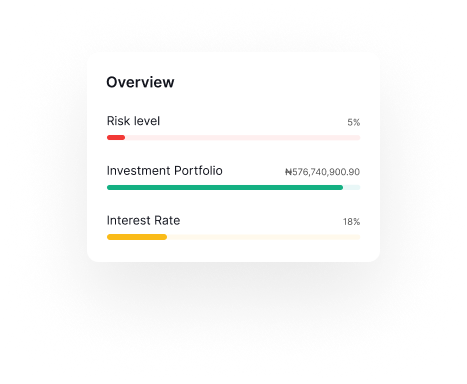

- Enjoy competitive returns on your investments; our interest rates can provide you with a steady income stream.

- We provide security on your investments; we reduce the risk of default using collateral or invoices as security.

- Gain visibility into the details of each transaction, ensuring you are well-informed about your investments.

Unlock YourPotential!

Desire Capital to Fuel Your Work Order Success?

With our top notch services, you'll have the financial firepower you need to conquer any project with confidence. Seize the opportunity to accelerate your growth.

Awaiting Pending Invoices to Fuel Your Business?

Our game-changing Invoice Discounting service is here to boost your cash flow, ensuring that your business never misses a beat.

Ready to Build Your Credit and Soar to New Heights?

We are your ultimate partner, dedicated to fostering personal relationships, delivering unparalleled customer service, and ensuring that you become an unstoppable force in the business world.

Transform your Working Capital Solutions Experience with us.

Vendor

Funder

This is Us

Empower your Business

Optimize Working Capital

Our unique solution empowers businesses to unlock cash flow potential, fuel growth, and establish dominance in their supply chains.

Supercharge Your Cash Flow. Scale Your Business.

Ensure a steady stream of working capital to fuel your business growth, and scale to new heights.

Maximize Profitability. Minimize Risk.

Maximize your profitability by optimizing working capital, reducing costs, and minimizing financial risk. Gain the peace of mind to focus on your core business while we handle your financing needs.

Seize Opportunities. Stay Ahead in the Game.

Leverage our solutions, seize lucrative opportunities, stay ahead of the competition, and maintain a strong market position with the financial agility and flexibility needed to capitalize on emerging trends.

Wall of Fame

Trusted by forward-thinking businesses

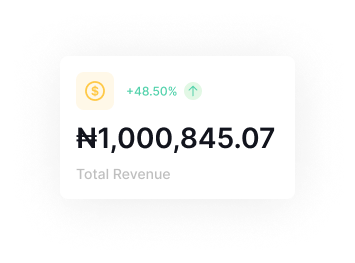

Unstoppable Numbers

Frequently Asked Questions

Supply Chain Financing (SCF) is a financial solution that helps businesses optimize cash flow by providing early payment to suppliers against their outstanding invoices. It allows buyers to extend payment terms while offering suppliers access to faster funding at competitive rates.

It is a digital platform that connects Suppliers, Issuers, and Funders. Suppliers can upload their invoices, and buyers/issuers can review and approve these invoices for early payment. Funders provide the funding, and once approved, the supplier receives payment within 48 hours.

- For Businesses/Suppliers: Faster access to cash and reduced payment uncertainty.

- For Issuers/Business Buyers: Extended payment terms, and stronger supplier relationships.

- For Funders: Attractive investment opportunities with lower risks due to the involvement of creditworthy buyers.

Yes, we employ robust encryption and data protection measures to ensure the confidentiality and safety of all user data and financial transactions.

Yes, our platform caters to businesses of all sizes, from small enterprises to large corporations.

Simply visit our website and click on the signup button and follow the on-screen instructions to start using the features.

Yes, depending on the type of service and the volume of transactions. We aim to keep our fees competitive and transparent, ensuring our users can easily understand the costs involved.

Basic personal and/or business details, identification documents, and financial information. Additional documentation may be requested during the due diligence process for verification purposes.

Within 24 to 48 hours.

Absolutely! We provide real-time tracking of transactions allowing you to stay updated on your financing activities.

Testimonials

Grow gave us the financing and support we required to meet up with our supply order. We were able to retain and grow our businesses as a result. Don't know what we would have done without Grow

Olusegun Adewole

Super thankful for the prompt service from Grow in financing my working capital gap. They have helped my company meet business obligation while we awaited out invoices to be fully paid.

Daivd Zeruwa

Their promptness in revieweing and approving my LPO Financing application is mind-blowing. Excellent customer service too. I will definitely continue to partner with Grow to achieve my business goals.

Hassan Abdullahi

Excellent and top-notch service.

Jimoh Bolatito

Good company with excellent service.

Abola Paul Olusoji

Seamless and smooth service.